While Metro Vancouver home sellers appeared somewhat hesitant in January, new listings rose 31 per cent year-over-year in February, bringing a significant number of newly listed properties to the market.

Greater Vancouver REALTORS® (GVR) reports that residential sales in the region totalled 2,070 in February 2024, a 13.5 per cent increase from the 1,824 sales recorded in February 2023. This was 23.3 per cent below the 10-year seasonal average (2,699).

“While the pace of home sales started the year off briskly, the pace of newly listed properties in January was slower by comparison. A continuation of this pattern in February would have been concerning, as it could quickly tilt the market towards overheated conditions,” Andrew Lis, GVR’s director of economics and data analytics said. “With new listings up about 31 per cent year-over-year in February, this will relieve some of the pressure that was building in January and offer buyers more choice as we enter the spring and summer markets.”

There were 4,560 detached, attached and apartment properties newly listed for sale on the Multiple Listing Service® (MLS®) in Metro Vancouver in February 2024. This represents a 31.1 per cent increase compared to the 3,478 properties listed in February 2023. This was 0.2 per cent below the 10-year seasonal average (4,568).

The total number of properties currently listed for sale on the MLS® system in Metro Vancouver is 9,634, a 16.3 per cent increase compared to February 2023 (8,283). This is three per cent above the 10-year seasonal average (9,352).

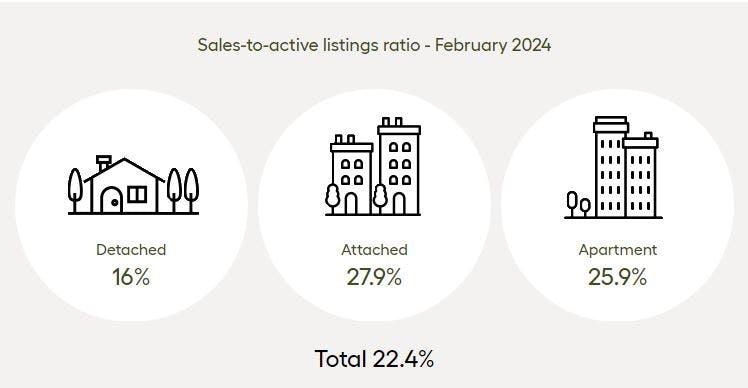

Across all detached, attached and apartment property types, the sales-to-active listings ratio for February 2024 is 22.4 per cent. By property type, the ratio is 16 per cent for detached homes, 27.9 per cent for attached, and 25.9 per cent for apartments.

Analysis of the historical data suggests downward pressure on home prices occurs when the ratio dips below 12 per cent for a sustained period, while home prices often experience upward pressure when it surpasses 20 per cent over several months.

“Even with the increase in new listings however, standing inventory levels were not high enough relative to the pace of sales to mitigate price acceleration in February, with most segments of the market moving into sellers’ territory,” Lis said. “This competitive dynamic has led to modest price growth across all market segments this month, but it’s noteworthy that benchmark prices remain below the peak observed in the spring of 2022, before the market internalized the full effect of the Bank of Canada’s tightening cycle.”

The MLS® Home Price Index composite benchmark price for all residential properties in Metro Vancouver is currently $1,183,300. This represents a 4.5 per cent increase over February 2023 and a 1.9 per cent increase compared to January 2024.

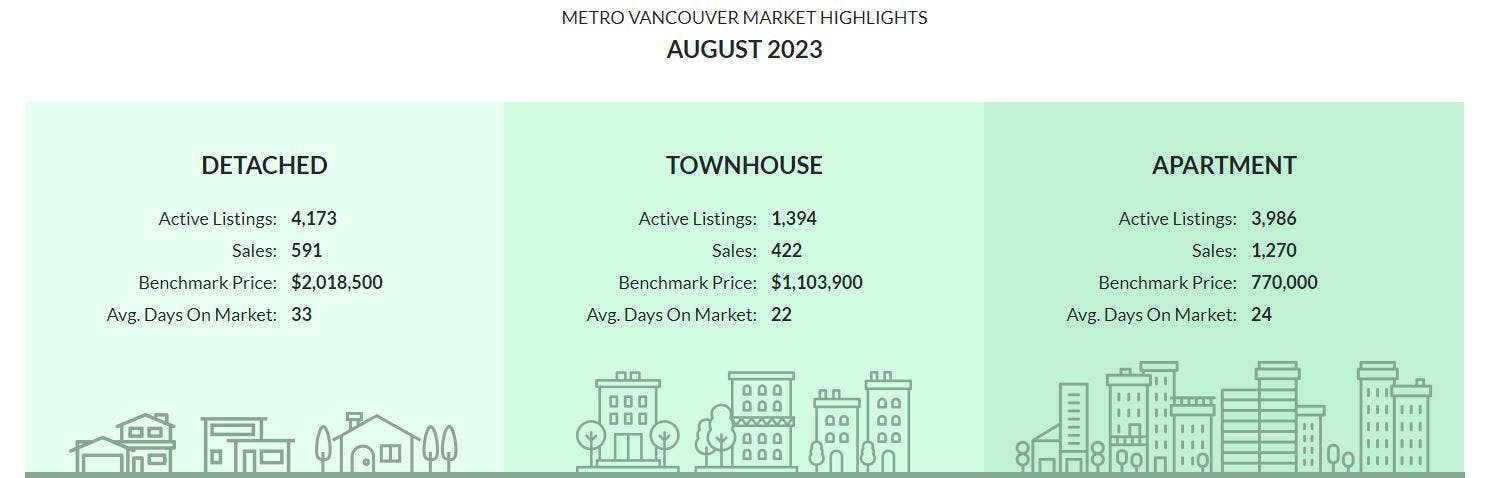

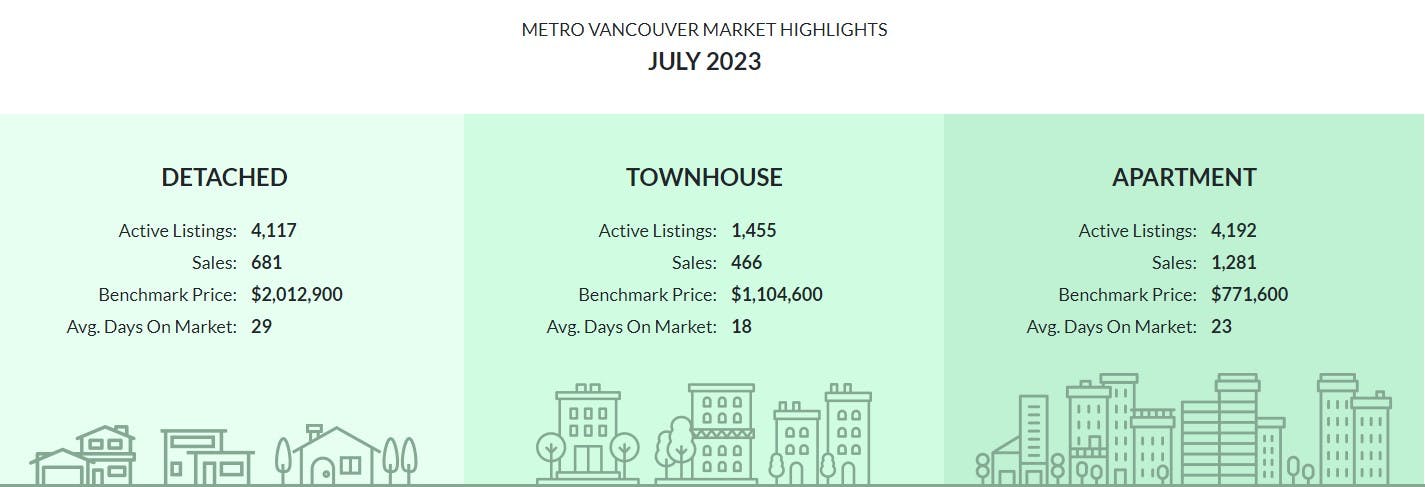

Sales of detached homes in February 2024 reached 560, an 8.3 per cent increase from the 517 detached sales recorded in February 2023. The benchmark price for a detached home is $1,972,400. This represents a 7.2 per cent increase from February 2023 and a 1.5 per cent increase compared to January 2024.

Sales of apartment homes reached 1,092 in February 2024, a 17.7 per cent increase compared to the 928 sales in February 2023. The benchmark price of an apartment home is $770,700. This represents a 5.6 per cent increase from February 2023 and a 2.5 per cent increase compared to January 2024.

Attached home sales in February 2024 totalled 403, a 10.1 per cent increase compared to the 366 sales in February 2023. The benchmark price of a townhouse is $1,094,700. This represents a 4.2 per cent increase from February 2023 and a 2.6 per cent increase compared to January 2024.